Alexander Hamilton Orders That Bank Notes of the Branches of His New Bank of the United States Are to Be Accepted by the United States Government

Contrary to some local practice, “These notes being, in fact, notes of the Bank of the United States, signed by their President and Cashier, and having the same leading marks for distinguishing counterfeits from the genuine, as have been already communicated to you, are to be received and exchanged in like manner as heretofore directed.”

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise money. A main goal of the new U.S. Constitution was the correction of that defect, and with the support of advocates like Alexander Hamilton and James Madison, it...

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise money. A main goal of the new U.S. Constitution was the correction of that defect, and with the support of advocates like Alexander Hamilton and James Madison, it established a means to fund the country by authorizing Congress to collect taxes to raise revenue. This revenue would come principally from tariffs and tonnage duties on goods coming into the U.S., which would be collected at customs houses at the ports of entry. On July 4, 1789, an act was passed formalizing this procedure by allowing for the collection of import duties. The Collectors of these customs houses were appointed by President Washington, and were men of substance who could be relied on (for example, Signer of the Declaration of Independence William Ellery was the first Collector in Newport, R.I.). In September of 1789, in one of the first substantial Acts of Congress passed and signed by President Washington, the U.S. Treasury was formed. That same month, Alexander Hamilton became the first U.S. Treasury Secretary. This put in place an agency to handle the nation’s finances.

On assuming the position of Secretary of the Treasury, Hamilton found himself entirely without funds to meet the expenses of the government except by borrowing until such time as the revenues from duties on imports and tonnage began to come into the Treasury. Under these circumstances he made arrangements with the Bank of New York and the Bank of North America for temporary loans, and it was the money received from these banks that paid the first installment of salary due President Washington, senators, representatives, and officers of Congress during the first session under the Constitution.

The United States Department of Treasury lists this loan in its publication, “The National Loans of the United States,” as the first ever taken by the government under the Constitution. It goes on to describe the negotiations undertaken in September and October 1789 for these loans. On September 13, Hamilton wrote to the head of the Bank of North America, referencing his appointment as Secretary of the Treasury, and adding, “A sum of Eighty thousand Dollars is immediately wanted. The Bank of New York have lately advanced Twenty thousand for another purpose; and have agreed to advance a further sum of Thirty thousand. There remains Fifty to be provided…” This loan was granted.

The Collectors, Hamilton’s men on the ground at the port cities who collected the tariff revenue for the new nation, had an important part to play in implementing these loans. Writing to them on September 22, 1789, Hamilton stated: “In consequence of arrangements lately taken with the Bank of North America, and the Bank of New York, for the accommodation of the Government, I am to inform you that it is my desire, that the Notes of those Banks, payable either on demand, or at no longer period than thirty days after their respective dates; should be received in payment …as equivalent to Gold and Silver, and they will be received from you as such, by the Treasurer of the United States.” This instruction on bank notes culminated on October 14, 1789, with a letter from Hamilton conveying to the Collectors the means to accept these notes from the Banks, and also issuing detailed instructions on how to treat them, and directions for sending them to the Treasury Department.

The Bank of the United States, now commonly referred to as the first Bank of the United States, opened for business in Philadelphia on December 12, 1791, with a twenty-year charter. Branches opened in Boston, New York, Charleston, and Baltimore in 1792, followed by branches in Norfolk (1800), Savannah (1802), Washington, D.C. (1802), and New Orleans (1805). The bank was overseen by a board of twenty-five directors. Thomas Willing, who had been president of the Bank of North America, accepted the job as the new national bank’s president.

In addition to its activities on behalf of the government, the Bank of the United States also operated as a commercial bank, which meant it accepted deposits from the public and made loans to private citizens and businesses. Its banknotes (paper currency) most commonly entered circulation through the loan process. It extended more loans and issued more currency than any other bank in the nation because it was the largest financial institution in the United States and the only institution holding federal government deposits and possessing branches throughout the nation. Banknotes issued by the Bank of the United States were widely accepted throughout the country. And unlike notes issued by state banks, Bank of the United States notes were the only ones accepted as payment of federal taxes.

In January of 1792, Hamilton extended his 1789 instruction to his new bank, writing, “The Bank of the United States being now in operation, I have to desire that you will extend my instructions of the 22d of September 1789, in regard to receiving the Cash Notes and Post Notes of the Bank of North America, to the Cash Notes and Post Notes of the Bank of the United States, which are to be received and exchanged in like manner.”

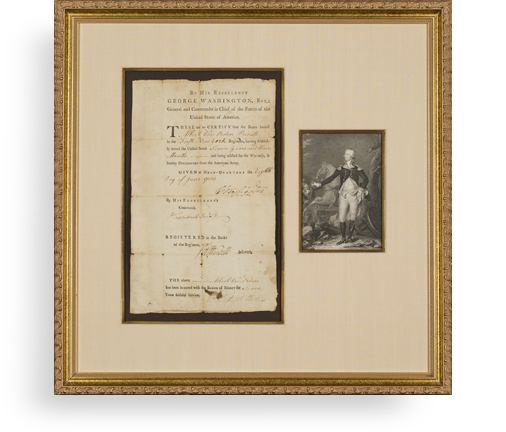

Printed letter signed, Treasury Department letterhead, March 29th, 1793.

He begins by discussing regulations relating to incoming vessels and how to assign them proper duties, particularly if they had been modified since their last measurements. He ends with an instruction that the notes of the Bank of the United States, even branch notes, are to be accepted.

“Sir, A question has been made – ‘What is to be the voucher to a Collector, for entering anew a Vessel which has been altered in form only?’ The 6th Section of the Act, concerning the Registering and Recording of Ships or Vessels, having made provision only for the case of an alteration in burthen.

“I answer, that the form of a Certificate of Registry, prescribed by the 9th Section of that Act, supposes a Certificate from the Surveyor, or person acting in his stead, for the special occasion, in every instance, except, merely, that of a transfer of property, when provision is made for referring to the former Certificate of Registry, as a substitute. It follows, then, that in the case of an alteration in form as well as burthen, such a Certificate is necessary, as an official description of the Vessel and a voucher for her Registry.

“The only difference will be, that, when altered in burthen, a Vessel must be actually measured anew, to ascertain her tonnage – when only altered in form, so as not to affect her burthen, the tonnage may be certified from her old Register. And, in the first place, a fee for admeasurement will be due, in the last, none.

“As an arrangement, which will conduce to the mutual convenience of the Officers of the Customs and of the Treasury – I am to request that all communications, which may be requisite after the receipt of this letter, relating to matters arising under either of the two Acts—the one entitled, ‘An Act concerning the Registering and Recording of Ships and Vessels,’ the other, entitled, ‘An act for enrolling and licensing Ships or Vessels to be employed in the Coasting Trade and Fisheries and for regulating the same,’ may be addressed to the Comptroller of the Treasury, and that the instructions which shall be transmitted by him, in relation to these laws, may be considered of the like force, as if proceeding directly from the Head of this Department. It is, however, not intended by this to prevent an immediate recourse to the Secretary of the Treasury in any special case or circumstance, which may be thought to render it necessary.

“All documents, directed by either of these acts to be transmitted to the Treasury, are to be forwarded immediately to the Register of the Treasury.

“It appears that some of the Collectors have put a construction upon my circular letter of the 2d of January 1792, which precludes the Cash notes and Post notes of the Branch Banks, or Offices of Discount and Deposit, from being received for duties, and exchanged for specie. This is contrary to the design of that instruction – These notes being, in fact, notes of the Bank of the United States, signed by their President and Cashier, and having the same leading marks for distinguishing counterfeits from the genuine, as have been already communicated to you, are to be received and exchanged in like manner as heretofore directed.”

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services