American Banking Giant Stephen Girard, in a Very Early Letter to the Cashier of the Bank of the United States, Subscribes to the Great Loan of 1798 During the Quasi War With France

The recipient, the Cashier of the Bank, would later be Girard's cashier at his Girard Bank

This letter is from a private collection put together generations ago and is apparently unpublished

The President, Directors and Company of the Bank of the United States, commonly known as the First Bank of the United States, was a national bank, chartered for a term of twenty years by the United States...

This letter is from a private collection put together generations ago and is apparently unpublished

The President, Directors and Company of the Bank of the United States, commonly known as the First Bank of the United States, was a national bank, chartered for a term of twenty years by the United States Congress on February 25, 1791. It followed the Bank of North America, the nation’s first de facto national bank. However, neither served the functions of a modern central bank: They did not set monetary policy, regulate private banks, hold their excess reserves, or act as a lender of last resort. They were national insofar as they were allowed to have branches in multiple states and lend money to the U.S. government. Other banks in the US were each chartered by, and only allowed to have branches in, a single state. Establishment of the Bank of the United States was part of a three-part expansion of federal fiscal and monetary power, along with a federal mint and excise taxes, championed by Alexander Hamilton, first Secretary of the Treasury. Hamilton believed a national bank was necessary to stabilize and improve the nation’s credit, and to improve handling of the financial business of the United States government under the newly enacted Constitution.

After the toppling of the French crown during its revolution, the United States refused to continue repaying its debt to France on the grounds that it had been owed to a previous and now unseated regime. Then the U.S. signed the Jay Treaty with Britain which was a treaty of friendship and trade. French outrage led to a series of attacks on American shipping, and by the time John Adams became President in March of 1797, the French had seized nearly 300 American ships bound for British ports. This led to the Quasi-War, which was an undeclared war between the U.S. and France that lasted from July 1798 to 1800.

In July of 1798, Congress passed “An Act to enable the President of the United States to borrow money for the public service”: “That the President of the United States shall be, and hereby is authorized to borrow, on behalf of the United States, from the Bank of the United States, which is hereby authorized to lend the same, or from any other body or bodies politic or corporate, or from any person or persons and upon such terms and conditions as he shall judge most advantageous for the United States, a sum not exceeding five millions of dollars, in addition to the monies to be received into the treasury of the United States, from taxes, for making up any deficiency in any appropriation heretofore made by law, or to be made during the present session of Congress; and defraying the expenses which may be incurred, by calling into actual service, any part of the militia of the United States, or by raising, equipping and calling into actual service any regular troops, or volunteers, pursuant to authorities vested or to be vested in the President of the United States, by law.”

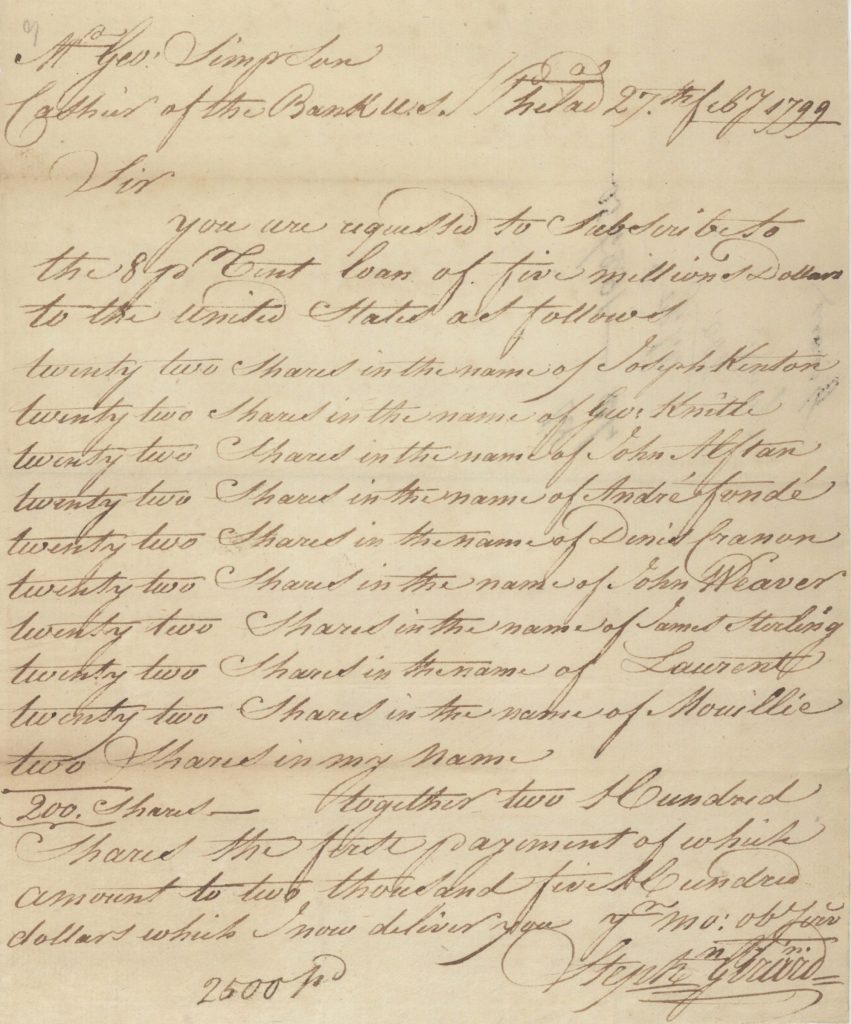

Autograph letter signed, Philadelphia, February 27, 1799, to George Simpson, Cashier of the Bank of the United States. This is an incredibly early letter of Girard. We found no earlier example reaching the market in the last century.

“Sir, you are requested to subscribe to the 8 percent loans of five million dollars to the United States as follows:

Twenty two shares in the name of Joseph Kinton

Twenty two shares in the name of George Knitle

Twenty two shares in the name of John Alftan

Twenty two shares in the name of Andre Fonde

Twenty two shares in the name of Denis Cranon

Twenty two shares in the name of John Weaver

Twenty two shares in the name of James Sterling

Twenty two shares in the name of Laurent

Twenty two shares in the name of Mouillie

Two shares in my name.

“Together two hundred shares the first payment of which amount to two thousand five hundred dollars which I now deliver you.”

It is not clear what became of this subscription, as history does not apparently record it. The names of these subscribers imply that at least some of them were foreign. The loan was massively oversubscribed and not all orders were honored, perhaps including these.

Girard went on to become one of the richest men in American history. After the charter for the First Bank of the United States expired in 1811, Girard purchased most of its stock and its facilities on South Third Street in Philadelphia, and re-established it under his direct personal ownership. He hired George Simpson, the same cashier of the First Bank he addresses here, as cashier of the new bank, and with seven other employees, opened for business on May 18, 1812.

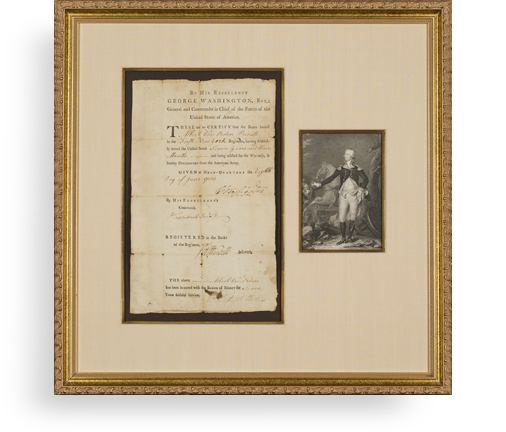

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services